Molto importante! Si tratta di un articolo sull'IVA per il drop shipping e il magazzinaggio in Germania. Entro il 2025, si prevede che il mercato tedesco dell'e-commerce supererà i 120 miliardi di euro, diventando il più grande mercato di vendita al dettaglio online in Europa. Tuttavia, dietro questo oceano blu si nasconde una "trappola della conformità": l'autorità fiscale tedesca (Finanzamt) ha adottato un approccio di "tolleranza zero" per reprimere le violazioni fiscali nel commercio elettronico transfrontaliero. Secondo le statistiche, nel 2024 sono stati bloccati oltre 50.000 account di venditori a causa di IVA (Imposta sul Valore Aggiunto) non registrata, per un valore di oltre 200 milioni di euro. Un venditore di Amazon Germania una volta ha confessato: "Pensavo che l'utilizzo di magazzini tedeschi all'estero avrebbe ridotto i costi, ma la mancata registrazione dell'IVA ha comportato il pagamento di tre anni di tasse arretrate, che hanno direttamente interrotto il mio flusso di cassa".

Lettura di ampliamento: L'imposta sul valore aggiunto in Germania: tutto quello che c'è da sapere

In questo contesto, la conformità all'IVA è passata da una "scelta facoltativa" a un "requisito obbligatorio di sopravvivenza".

IVA per Dropshipping e Magazzino in Germania. Assicuratevi di avere una conformità IVA che è una base di sopravvivenza per il commercio elettronico transfrontaliero.

Obbligo legale: La "soglia rigida" del diritto tributario tedesco

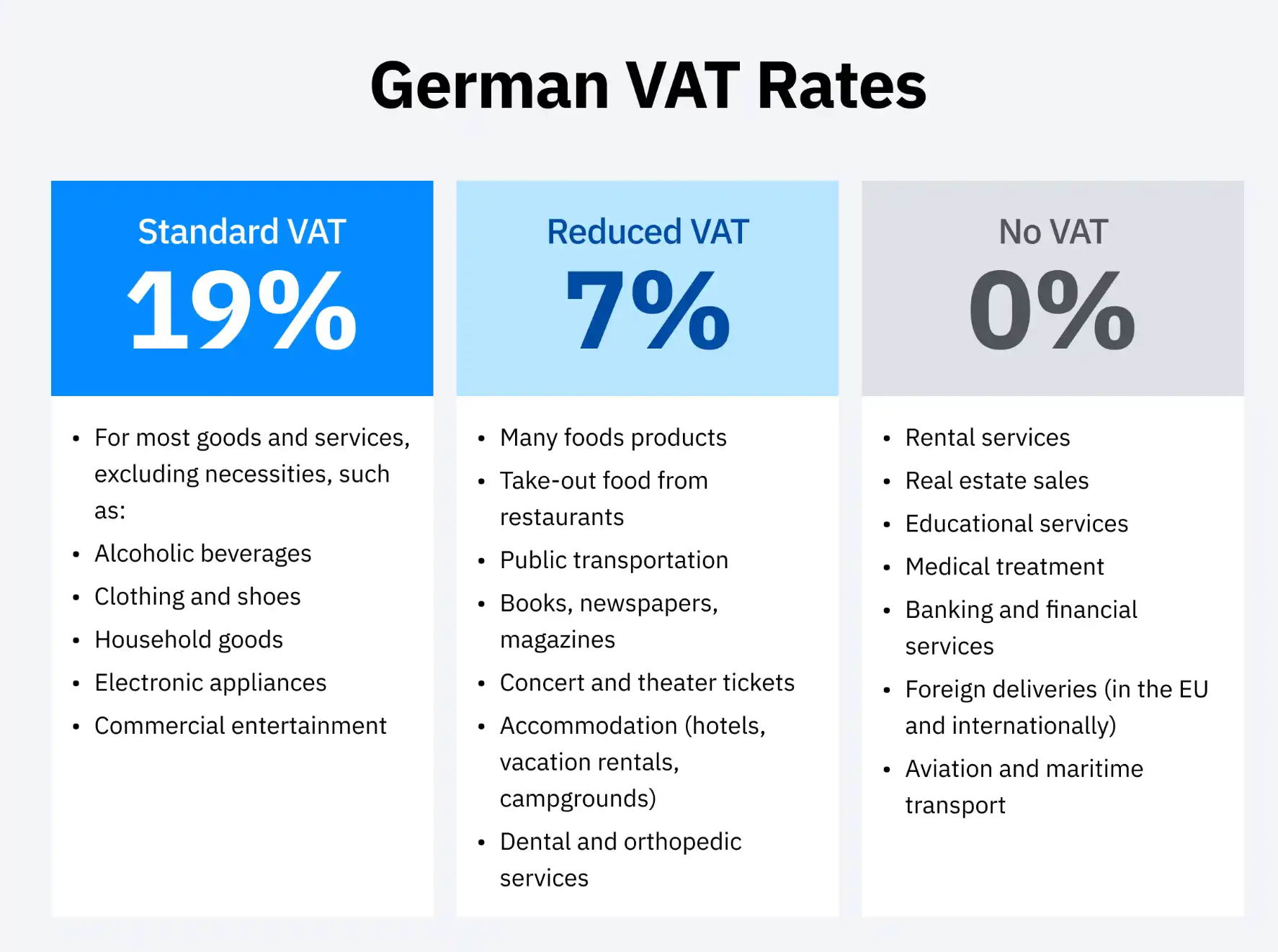

Secondo la Germania Legge sull'imposta sul valore aggiunto (Umsatzsteuergesetz, UStG) e il Direttiva IVA dell'UE (2006/112/CE)Le imprese extracomunitarie sono tenute a registrarsi ai fini dell'IVA quando operano in Germania. Gli scenari specifici includono:

Presenza di strutture di stoccaggio:

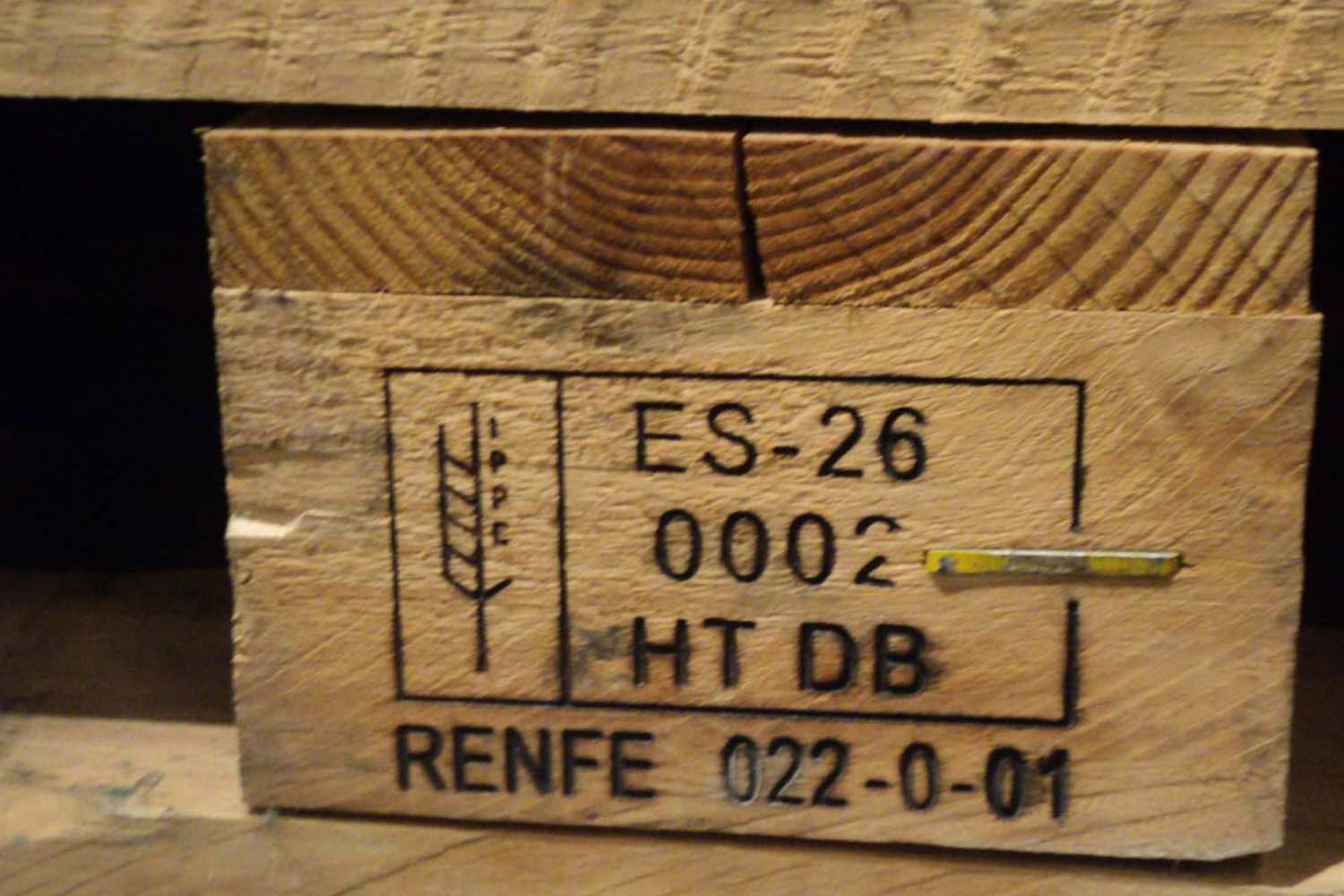

Se un'azienda ha merci immagazzinate in Germania (ad esempio, utilizzando Amazon FBA o magazzini di terzi), la registrazione IVA è obbligatoria, indipendentemente dal volume delle vendite.

Soglia di vendita a distanza superata:

La soglia per le vendite a distanza a livello europeo rimarrà a 10.000 euro nel 2025. Se il totale delle vendite transfrontaliere supera questa soglia, è necessaria la registrazione IVA in Germania.

Vendite su piattaforme di e-commerce:

Le imprese extracomunitarie che vendono ai consumatori tedeschi tramite piattaforme come Amazon o eBay devono fornire un numero di partita IVA valido.

Regole della piattaforma: Niente IVA, niente conto

Piattaforme come Amazon Germania hanno chiarito che i venditori devono fornire un numero di partita IVA valido, altrimenti i loro conti saranno congelati. Nel 2025, la cooperazione tra l'autorità fiscale tedesca e le piattaforme di e-commerce si intensificherà. Attraverso il meccanismo "informazioni non valide → blocco del conto", le aziende che violano le tasse dovranno affrontare sanzioni rapide. Ad esempio:

I venditori che utilizzano lo stoccaggio FBA ma non registrano l'IVA entro 30 giorni riceveranno una lettera di avvertimento dall'autorità fiscale.

Se un venditore presenta dichiarazioni IVA nulle per tre mesi consecutivi senza una valida prova commerciale, il suo numero di partita IVA può essere revocato.

Rischi finanziari: Il "doppio colpo" delle multe e dei ritardi. IVA per il Dropshipping e il Magazzinaggio in Germania

Le imprese che non si registrano ai fini dell'IVA corrono i seguenti rischi:

Multe se non si registra l'IVA per il dropshipping e il magazzino in Germania:

La registrazione o la presentazione tardiva dell'IVA può comportare multe che vanno da 1% a 10% dell'imposta non pagata, con una sanzione massima di 25.000 euro.

Pagamenti arretrati:

Le imprese possono essere tenute a pagare l'IVA arretrata e le spese di mora, che possono superare di gran lunga l'importo originario dell'imposta.

Sequestro di merci:

L'autorità fiscale ha il diritto di sequestrare i beni corrispondenti all'IVA non pagata fino alla risoluzione della questione.

Fiducia dei consumatori: La conformità aumenta la competitività

I consumatori tedeschi preferiscono acquistare prodotti con IVA inclusa, in quanto ciò garantisce la trasparenza dei prezzi ed evita controversie post-vendita. La registrazione dell'IVA può anche aumentare la credibilità del negozio e attirare più acquirenti. Ad esempio, un sondaggio di Xiaohongshu (Little Red Book) ha dimostrato che 83% dei consumatori tedeschi danno la priorità ai venditori che espongono l'IVA sui loro prodotti.

Piano d'azione: 3 passi per la conformità IVA in Germania entro il 2025. IVA per il Dropshipping e il Magazzinaggio in Germania.

Fase 1: condurre un'autovalutazione per determinare se è necessaria la registrazione

Presenza in magazzino:

Verificate se state utilizzando magazzini tedeschi (incluso FBA).

Soglia di vendita:

Calcolate se le vostre vendite transfrontaliere totali nell'UE superano i 10.000 euro all'anno.

Vendite della piattaforma:

Confermate se state vendendo su piattaforme tedesche come Amazon o eBay.

Passo 2: Registrarsi rapidamente presso gli agenti fiscali professionisti

Documenti necessari:

Licenza commerciale, passaporto del rappresentante legale, link al negozio e contratti di magazzino.

Tempo di elaborazione:

La registrazione standard richiede 4-6 settimane. I servizi accelerati possono ridurre i tempi a 2 settimane (con un costo aggiuntivo di 30%).

Numero di partita IVA Rilegatura:

Una volta registrati, aggiornate immediatamente il vostro numero di partita IVA nel backend della piattaforma e compilate la vostra prima dichiarazione dei redditi.

Fase 3: Mantenere la conformità costante con un sistema di gestione fiscale

Integrazione del sistema:

Utilizzate il software ERP per sincronizzare automaticamente i dati di vendita e le dichiarazioni fiscali.

Archiviazione trimestrale:

Presentare le dichiarazioni IVA in tempo per evitare di non dichiarare nulla o di non dichiarare nulla.

Audit annuale:

Conservare tutte le fatture IVA a credito per prepararsi a eventuali controlli fiscali.

A quanto pare, nell'articolo precedente sull'IVA per il dropshipping e il magazzinaggio in Germania, sappiamo che la conformità all'IVA è un'azione "obbligata". Nel mercato tedesco dell'e-commerce transfrontaliero, la conformità all'IVA è passata dall'essere una "scelta opzionale" a un "requisito obbligatorio". Ogni caso di evasione fiscale riduce la credibilità di un'azienda, e ogni ritardo nella registrazione getta le basi per rischi futuri. La regola di sopravvivenza per il 2025 è semplice: o ci si adegua in modo proattivo o si è costretti a uscire dal gioco.

Quicker International Logistics (Shenzhen) Co., Ltd è una società di spedizioni one-stop di Shenzhen Cina. Forniamo spedizioni marittime DDP dalla Cina, spedizioni aeree DDP dalla Cina, servizi di magazzinaggio 3PL e servizi aggiuntivi per i mittenti globali che hanno elevate esigenze di spedizioni veloci dalla Cina all'indirizzo di destinazione del paese di destinazione.