Ocean plus last-mile express delivery (Sea-Express) refers to a logistics model where goods are shipped via ocean freight to the destination port, followed by last-mile delivery through local couriers (e.g., FedEx or UPS). This method is ideal for small-batch shipments (under 2 CBM) or e-commerce orders requiring door-to-door service.

Advantages:

Faster customs clearance (typically using express clearance channels). Flexible final-mile delivery, suitable for small parcels.

Disadvantages:

Higher per-unit costs (charged by weight or volume). Costs increase significantly for large shipments. This model balances speed and convenience for lightweight, time-sensitive cargo.

Let’s explaine more about this mode:

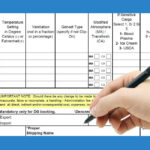

1. Detailed Process Flow

- Ocean Leg: Goods consolidated as LCL or FCL at origin ports (e.g., Ningbo/Hamburg), with 12-22 day transit times (US West Coast routes).

- Express Customs: Leveraging courier clearance channels (DDP terms) for sub-24h clearance vs 3-5 days in traditional海运.

- Last Mile: FedEx/UPS handles door delivery (including remote areas with surcharges), with real-time tracking visibility.

- End-to-End Timeline: 16-26 days China-US, 20-30 days China-EU (excluding peak season delays).

2. Key Applications

- Ideal Cargo:

- E-commerce parcels (≤30kg/0.5CBM per piece)

- Time-sensitive replenishment (inventory turnaround <30 days)

- Industry Adoption:

- 68% of Amazon FBA sellers use Sea-Express for cost/balance

- Emerging DTC brands (e.g., TikTok Shop sellers) favor sub-$5/kg rates

3. Advantages vs Limitations

| Factor | Benefits | Drawbacks |

|---|---|---|

| Speed | 50% faster than standard海运 | 15% slower than premium air freight |

| Cost | 3.2−5.8/kg (vs 9−15 for air cargo) | Volumetric weight penalizes low-density items |

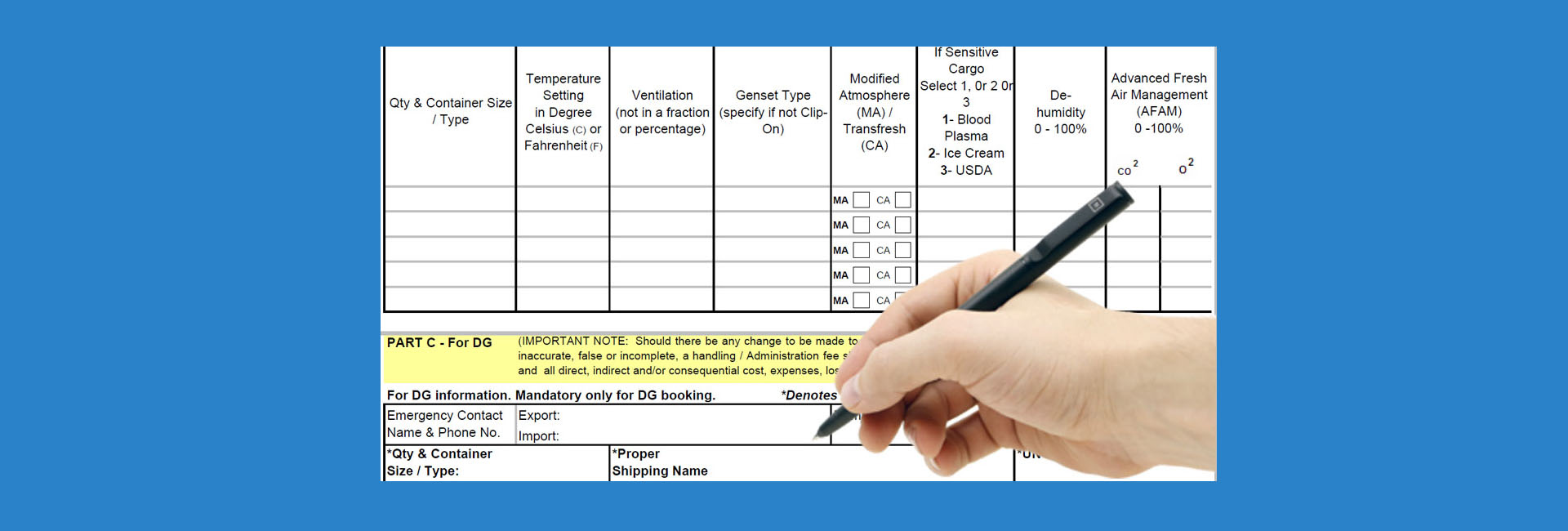

| Flexibility | Accepts shipments from 0.01CBM | Bans 9类危险品(锂电池/香水等) |

| Reliability | 98% on-time delivery for FCL shipments | Typhoon season disrupts sailing schedules |

4. 2024 Market Insights

- Volume: Global Sea-Express reached 4.2M TEU in 2023 (Drewry data), with 19% YoY growth in cross-border e-commerce.

- Pricing: Average rates dropped to $4.1/kg (-18% YoY), but BAF surges to 22% of total cost amid oil volatility.

- Innovations:

- Maersk’s “TradeLens” blockchain cuts documentation time by 40%

- Flexport’s AI predicts port congestion with 85% accuracy

5. Future Evolution

- Tech Integration:

- Automated X-ray scanning at ports (试点上海洋山港)

- Drone-assisted container unloading (DP World试验项目)

- Service Models:

- “Sea-Express + Micro-Fulfillment” hybrid networks (3PLs like ShipBob leading)

- Carbon-neutral options via biofuel vessels (CMA CGM’s 2025 target)

- Regulatory Shifts:

- EU’s new pre-declaration rules (2025) may add 1-2 days to clearance

- US Customs’ 24/7 clearance mandate to reduce dwell time by 30%

Strategic Recommendations

- For 2-10kg shipments: Sea-Express saves 35% vs air freight while maintaining <30-day delivery

- Monitor BAF fluctuations – Q4 2024 forecasts show 8-12% increase

- Partner with 3PLs offering hybrid solutions (e.g.,海运+海外仓一件代发)